The Plenary of the House of Representatives has directed its Committees on Good Governance; Ways, Means and Finance; and Judiciary to conduct a comprehensive review of a proposed bill aimed at revising key provisions of Liberia’s tax laws, particularly those governing personal income tax thresholds and investment incentives.

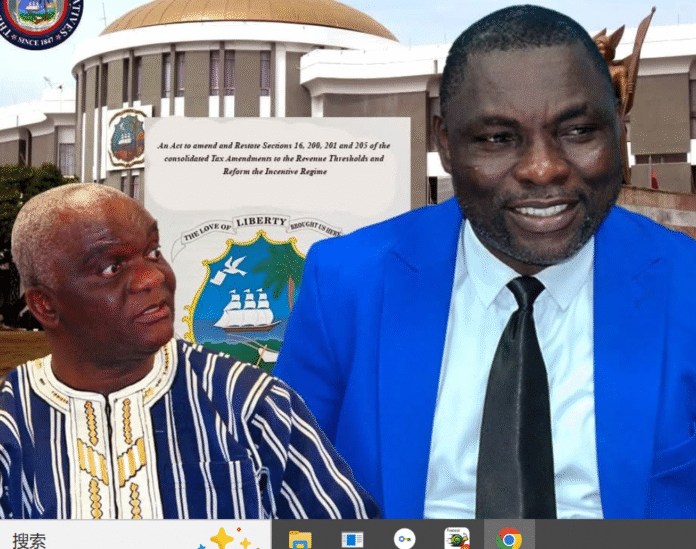

The decision followed the formal submission of the draft legislation by Maryland County Electoral District #2 Representative, Hon. Anthony F. Williams, who presented the bill for legislative consideration during a sitting of the House.

The proposed law, titled “An Act to Amend and Restate Sections 16, 200, 201, and 205 of the Consolidated Tax Amendments to the Revenue Code of Liberia (2000), as Amended, to Adjust Personal Income Tax Thresholds and Reform the Investment Incentive Regime,” seeks to modernize Liberia’s tax system. Its primary objective is to reduce the tax burden on low-income earners while restructuring the investment incentive framework to promote fairness, sustainability, and fiscal responsibility.

In presenting the bill, Rep. Williams informed Plenary that the legislation proposes to exempt employees earning up to Five Hundred United States Dollars (US$500), or its equivalent in Liberian dollars, from paying personal income tax. He explained that the initiative is intended to ease financial pressure on ordinary workers, particularly in light of ongoing economic hardships.

The lawmaker further noted that any potential loss in government revenue resulting from the higher tax exemption threshold would be mitigated through the suspension, review, and rationalization of selected tax incentives and waivers currently extended to investors and private sector entities. According to him, the reform is designed to strike a balance between revenue mobilization and social equity, while fostering sustainable economic growth.

After initial deliberations, Plenary unanimously agreed to forward the bill to the relevant committees for in-depth analysis, stakeholder consultations, and recommendations before it is returned to the full House for further legislative action.

The House of Representatives has reaffirmed its commitment to enacting legislation that enhances public financial management, strengthens good governance, and improves the socio-economic conditions of the Liberian people.